2020 Q1 Review and Outlook

“There are decades when nothing happens, and there are weeks when decades happen.”

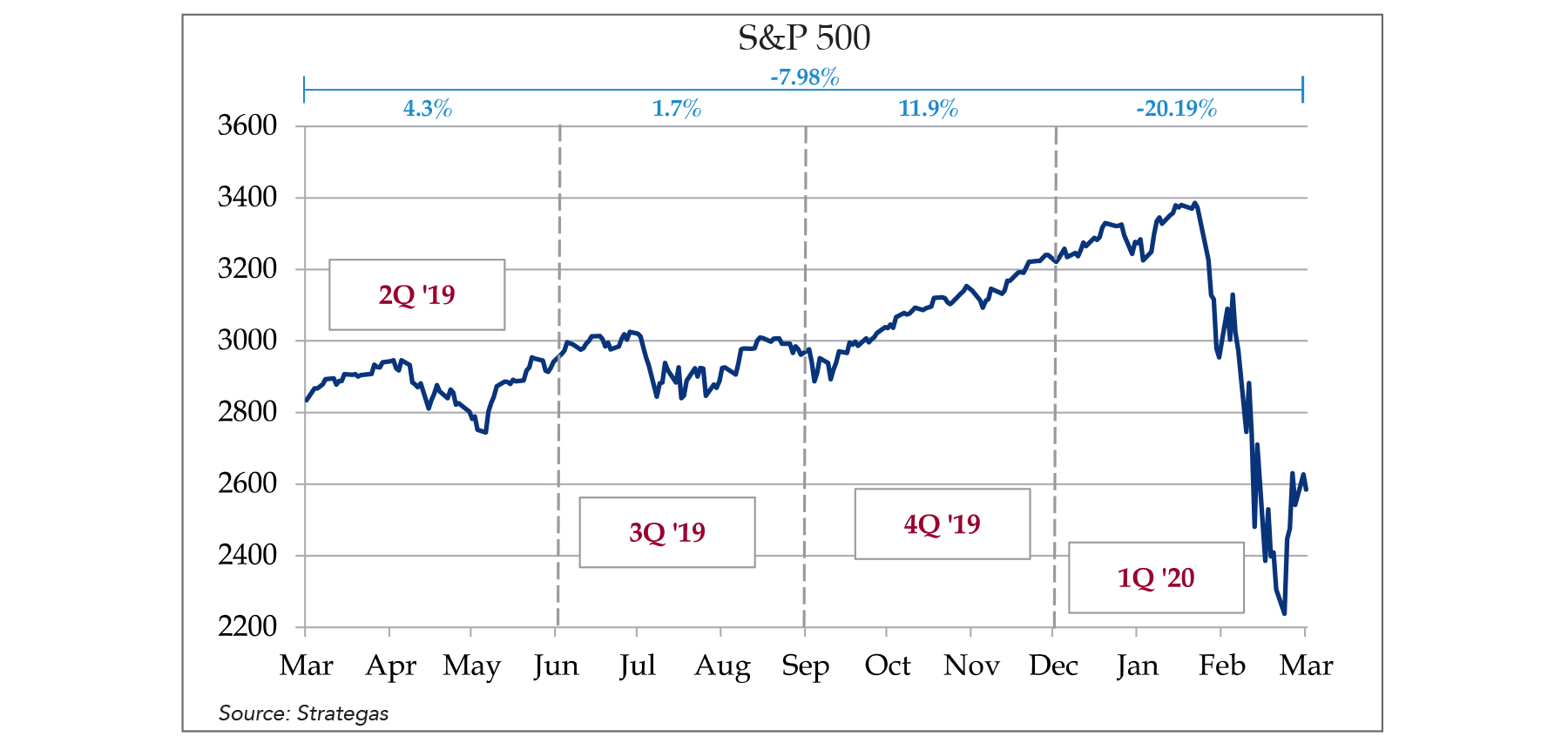

This quote (by Vladimir Lenin of all people) pretty much sums up the first quarter of 2020, as governments around the world instituted draconian methods to slow the pace of the spread of the Coronavirus (a.k.a. COVID-19). These actions are in essence hitting the “STOP” button on the world economy, and the markets reacted accordingly, with stocks (as measured by the Vanguard Total Stock Market ETF – VTI) falling 21.5% in the first quarter, the U.S. bond market (as measured by the US Aggregate Bond ETF – AGG) gaining 2.8%, and a 60% stock/40% bond portfolio losing 10.4%.

However, the end of quarter numbers don’t tell the whole story, as the drop in these three portfolios from Jan 1st to the recent low point less than 3 months later was 32% for stocks, 5% for bonds and 20% for a 60/40 portfolio. For comparison, stocks fell about 50% during the 2008-2009 financial crisis, but that took over a year to happen.

The stock market rallied in the first week of April on signs that the “social distancing” efforts have slowed the spread of COVID-19 (which in turn implies a possible re-start of the U.S. economy in the near future), but the forces hitting the markets are so large and the news (both bad and good) coming so quickly, that daily or weekly trends in the market are impossible to project forward to any investable time frame.

We posted our initial views of the Coronavirus on March 3rd and provided a shorter but more direct update of the specific actions we were taking (and continue to take) on March 27th, so we will focus on two topics in this update – 1) how have our views changed since our original post?; and 2) what are the key issues facing the U.S. and global economy and financial markets going forward?

First, a show of hands from the audience – how many people could find Wuhan, China on a map prior to January 2020? How many people knew that Wuhan was even a city in China prior to January 2020? How many highly paid “market strategists” could answer either of these two questions, much less identify a pandemic originating from there in early 2020? How many forecasts called for a 30% drop in the S&P 500?

This is one of the many reasons why we stay out of the short-term market forecasting game. While there are many potential risks to the economy and stock market, most of those risks are by their very nature unpredictable. We build these risks into the client’s long-term investment policy, so we don’t have to attempt to trade around them in the short-term.

With all that said, has our outlook changed since our original post? At the time of that post, there were about 93,000 cases and 3,200 deaths worldwide, with only 124 cases and 9 deaths in the U.S. As of April 13, 2020, there were 1.9 million cases and 118,500 deaths worldwide, with 577,000 cases and 23,000 deaths in the U.S. Exponential growth is terrific for investment returns, but horrible for pandemics! In the original post, we emphasized three key points:

1. Don’t do anything drastic, like move to 100% cash or chase hot “Coronavirus stocks.”

2. Look to rebalance if stocks fall far enough (relative to bonds) that the asset allocation is meaningfully different than your investment policy (we suggested more than 5 points off as a possible starting point).

3. This is a “transitory” event. It will hurt – badly – but the economy and financial markets will recover.

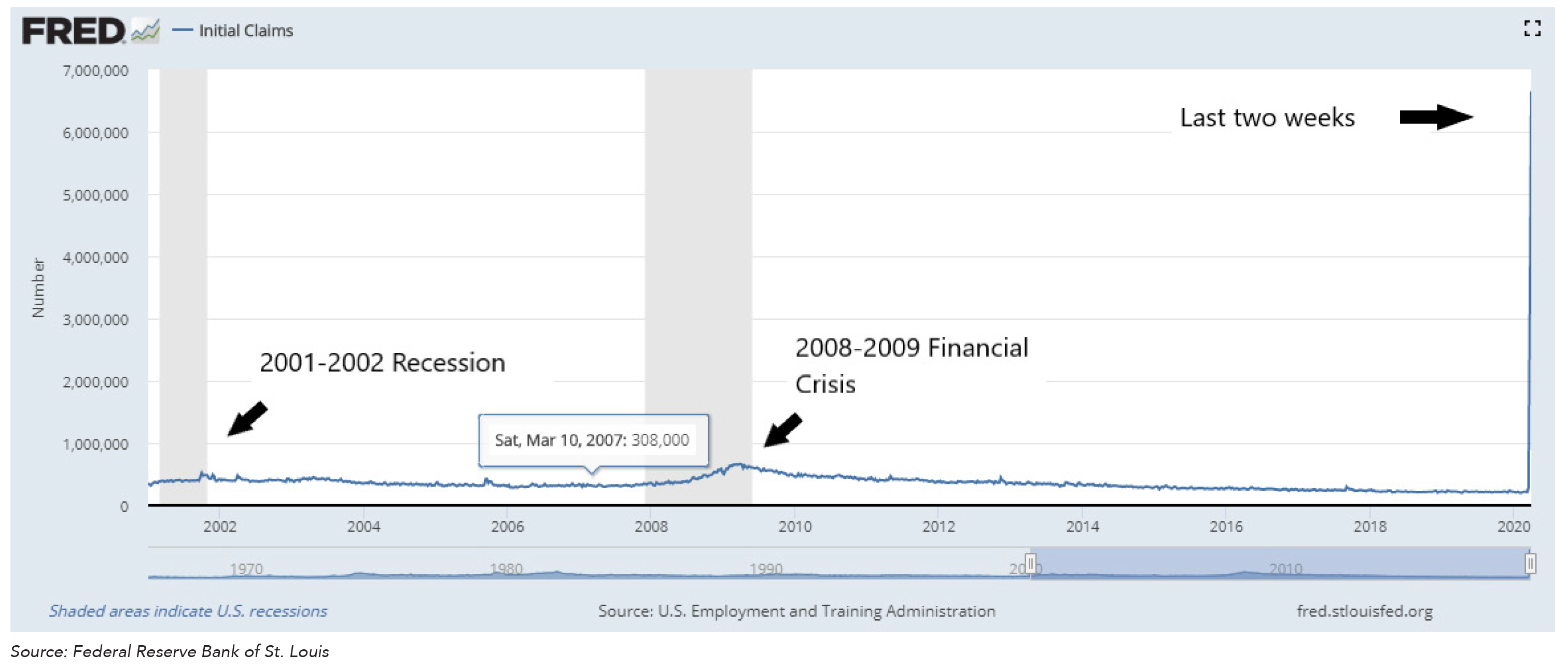

Looking back at all of this, we stand by our original advice. However, we did underestimate the spread of the virus – especially in major cities such as New York. We also underestimated how deeply the economy would be impacted by the lockdown and “social distancing.” The following chart pretty much tells the story.

This graph tallies the new unemployment claims made every week, and it looks like a typo. This is what pressing the STOP button looks like. Accordingly, we are now almost certainly in a recession. It’s heartbreaking, because the economy had been sort of chugging along at a nice steady pace, with GDP increases in the 2%+ range and unemployment below 4% for the first time since the late 1960s now has 16 million newly unemployed people, and rising.

So, what now? The near-term future of the U.S. economy has two main determinants: 1) the rate of spread of COVID-19 and 2) the continually evolving government containment efforts. While #2 has the most direct impact on the economy, #1 is what the various governors and Federal agencies are watching.

From these two factors, we can evaluate several scenarios, which require refreshing your alphabetical skills. Four letters describe the path of the economy over the next 6-12 months (in order of worst to best) – L, U, W and V. Those letters don’t stand for any words though – you must look at their shapes.

1) L – An L-shaped scenario is the worst-case outcome, as it describes an economy that drops like a rock and just trails along at a much lower level indefinitely. This is a Depression scenario and would reflect an unchecked spread of COVID-19 into every other major metro area (think of New York’s situation, only in 30 more cities) and the harshest lockdown situation for an indefinite time period. Not a fun thought.

2) U – A U-shaped scenario is also “not fun,” because it implies a long walk through the proverbial desert before any substantial recovery.

3) W – A W-shaped scenario implies a recovery then relapse, then another recovery – with the 2nd drop most likely caused by a “2nd wave” of the virus in the fall which is worse than expected.

4) V – A V-shaped scenario is the best-case outcome, as it implies a relatively quick restart and a manageable 2nd wave, due to some combination of government assistance, new treatments, a vaccine and/or improved testing and tracing systems to contain the inevitable “brushfires.”

Note that these are economic scenarios, not stock market scenarios. While the stock market will probably loosely match the ultimate “letter,” it will probably run ahead of what happens (which is why short-term market timing is so difficult).

If we had to guess, our “letter” would probably be either a “U” that has a relatively short base, or an uneven “W” with the right leg shallower than the left. It’s very hard to tell how quickly this will unfold, however, as there are still a ton of moving parts and unpredictable factors involved.

The key factors that we believe will affect the shape of the recovery are:

1) Continued “flattening of the curve” in new cases. This is one of the most-watched trends, and governors will most likely base their re-opening decisions on these trends (although with a large margin of safety).

2) The spread (or containment) of the virus across major metropolitan areas. Cities are much more vulnerable to uncontained spread due to their high density, and we have been fortunate that we aren’t seeing a New York City type of scenario in 5-10 other cities (other than New Orleans and Detroit, which have also been badly hit).

3) Development of infrastructure to catch the 2nd wave, such as rapid testing and vaccines/treatments.

4) Government stimulus. The first wave of $1,200 checks should be hitting bank accounts soon, and the small business loan program is slowly getting off the ground. The Federal Reserve is also stepping in to stabilize markets and avoid cascading financial failures that might spill over into the “real economy.” A second round of checks and/or loans would be a very positive sign. While we are big believers in the power of the free market, this is a (unfortunately necessary) government-mandated recession, so the phrase “you broke it, you bought it” applies here. It won’t completely fill the crater-sized hole blown in the economy, but it should partially bridge the gap until things start back up again.

As we continue to say, none of this is predictable in the short term, and the market will do a pretty good job of getting ahead of these trends (in either direction). In the meantime, we can make sure that we own high-quality companies with staying power and use rebalancing to let the market work in our favor (by buying more of what has gotten cheaper and selling what has become more expensive). Regardless of which “letter” shape the economic recovery takes, diversification and maintaining the asset allocation that is appropriate for your needs is still the best strategy. The future is unknown and in times of volatility and uncertainty it is best to not make things worse by guessing which way the market and economy may go over the short-term while sacrificing long-term planning.

Our continued best wishes for your health and a quick recovery from this crazy period.