2022 Q4 Review and Outlook – Closing out a Tumultuous Year.

Financial markets finished a rough year on a strong note as stocks (as measured by the S&P 500 SPDR ETF – SPY) gained 7.6% in the fourth quarter. The U.S. bond market (as measured by the US Aggregate Bond ETF – AGG) returned 1.6%, and a 60% stock/40% bond portfolio returned 5.2%. For the year, stocks declined 18.2%, bonds were down 13.0% and a 60/40 portfolio declined 16.1%.

Figure 1: S&P 500 quarterly performance, trailing four quarters.

Source: Strategas, Portfolio Visualizer

Putting 2022 in perspective.

As you stare at your somewhat deflated portfolio, it’s helpful to put this year in perspective. A lot can happen in a year, but sometimes the view changes when you zoom out and separate the longer-term trends from more transitory factors.

The market was frothy in 2021 – Aside from the fundamentals (profits, dividends, growth, etc.) a key investment factor to consider is valuation – how much are investors willing to pay for those profits? In December 2021, the answer was “a lot.” If stock prices grow faster than profits or dividends, then investors are increasingly confident that growth will persist or increase. There is also a constant tradeoff between stocks and safer but lower-return assets such as bonds or cash.

From 2012 to 2021, the dividend yield on the S&P 500 decreased from 2.2% to 1.2% as dividends grew at a healthy 7% annual rate. As profits continued to grow, investors became increasingly optimistic. Plus, the yield on the 10-year treasury bond dropped from an already low 1.8% in 2012 to 1.6% in 2021 (and dropped below 1% in 2020!), so the alternatives to stocks weren’t very compelling in 2021. Combine growing investor optimism with not many attractive alternatives and you get some froth.

In 2022 that optimism unraveled as increasing inflation reduced profit growth expectations and the 10-year treasury bond yield tripled to 3.8%. While dividends increased over 9% in 2022, pessimistic investors pushed the dividend yield up to 1.6%, as they realized that a) a 1.2% yield assumed a lot of future growth and b) safer alternatives became increasingly attractive.

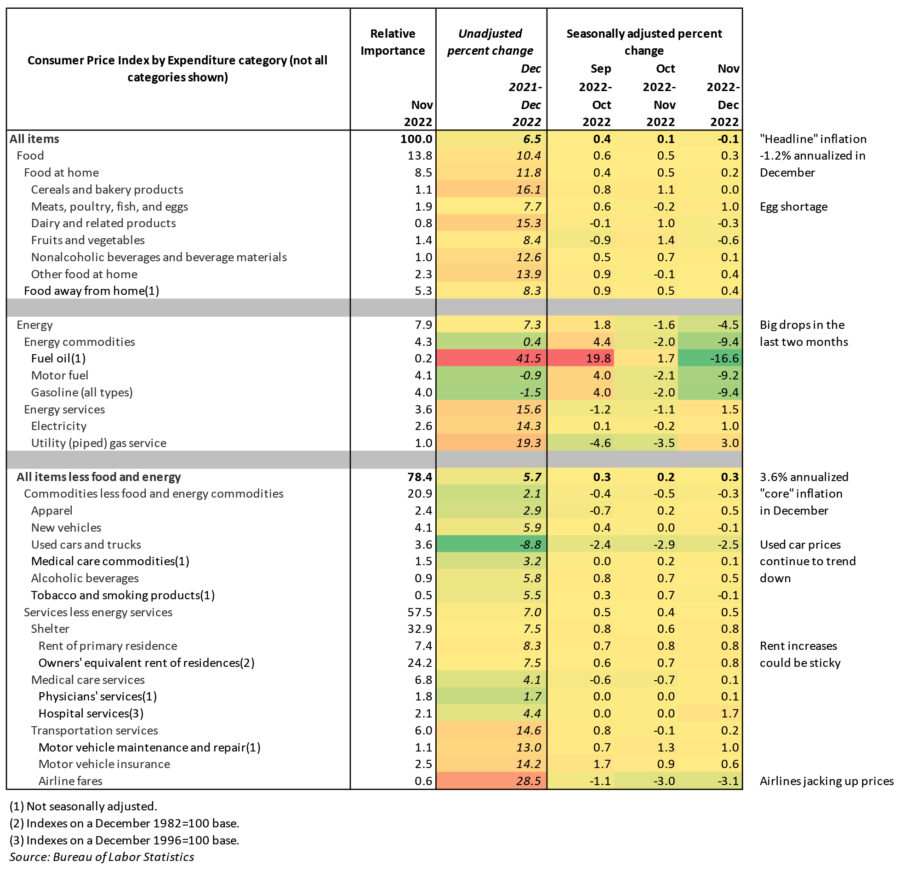

Megacap tech was hit hard – The S&P 500 is perhaps the most well-known stock index, and it is market-cap weighted, which means larger companies have more of an influence than the smaller ones, and the big companies were the driving force of returns from 2011-2021.

That all flipped in 2022, as the market cap weighted S&P 500 was trounced by the Equal Weight S&P 500 (which lost “only” 11.6% for the year). In fact, the equal weight index has almost caught up with the “regular” S&P 500 for 10-year performance (12.1% annual return vs. 12.5%). The megacap tech stocks in the following table were all in the top 10 weightings of the S&P 500 at the end of 2021, and they were hit extremely hard in 2022. We own Microsoft, Apple and Amazon in our Global Value Strategy, but we also own 35 other stocks (plus a few ETFs and Mutual Funds), and that served us well in a very tough 2022.

Figure 2: Megacap Tech Returns vs. Popular Indices, 2022

Source: Portfolio Visualizer

The last 3 years were surprisingly good for stock investors – If you only watched the news and social media for the past three years (which sounds like a cruel and unusual punishment for even a hardened criminal), you would have thought the world fell into a deep inescapable depression. Fortunately, we haven’t quite reached that point, and a stock investor did surprisingly well since January 2020, with the S&P 500 booking a 7.6% annual return. This was despite – and we will use this excellent quote by Joe Terranova of Virtus Investment Partners – “a global pandemic, war in Eastern Europe, 425 basis points of monetary tightening in six months, and 40-year highs for inflation.”

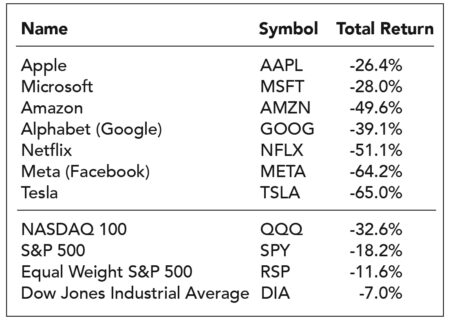

Dividends still growing (even accelerating) – Look at the chart below, and tell us which asset would you like to buy – the squiggly blue line or the nice smooth orange line? You own both if you own the S&P 500. The orange line is the trailing year’s annual dividends per share (indexed to 100 at January 2020) and the much more volatile blue line is the value of what’s left over after you get the dividends – i.e., the price. The dividends are what people get for owning a stock – the quarterly cash payments. The value of the stock is simply the sum total of everyone’s expectations for future dividends. What’s interesting is that the dividend growth and stock price growth have been going in opposite directions, with dividends finally returning to a healthy growth rate after suffering through the back-to-back shocks of COVID and inflation.

Figure 3: S&P 500, Price and Dividends per Share (January 2020 = 100)

Source: Yahoo Finance

Fortunately, the S&P 500 consists of actual companies with employees who show up (or log in) every day and are incentivized to deal with unexpected crises and solve tough problems. Thanks to their hard work, dividend growth has recovered.

We are not saying that everything is fine and stocks are going to go to the moon in 2023 now that dividend growth has accelerated. What we are saying is to simply look at the underlying fundamentals more often, and the crazy pogo stick stock prices less often.

Inflation hit everything – especially bonds – Although stocks captured most of the headlines in 2022, we believe that bonds were the biggest loser. As we covered in our last update, bond prices move inversely to interest rates, and interest rates increased a lot in 2022. Bonds (especially longer-term bonds) are very sensitive to inflation, as their payments are fixed – the only “employee” working for your bond is a computer sending out interest payments. If prices increase a lot, bond interest (except for inflation- indexed bonds, such as TIPS or Series I Bonds) stays the same. Therefore, bondholders demand higher rates on newly-issued bonds to cover increased inflation, which depresses current bond prices that don’t have these higher interest payments.

As a result, the Barclays Aggregate Bond Index recorded its worst one-year return since the index was formed in 1975. This was not fun for investors who had large bond allocations, because their bonds didn’t provide the usual cushion to offset their declining stock portfolios (which led to a 60/40 portfolio having one of its worst years since the Great Depression). When the yield on a 10-year treasury bond is 1.5% and inflation increases to 8%, something’s gotta give!

Fortunately, as we also noted in last quarter’s update, bond investors will still get their money back at maturity (assuming no default), even if the price plunges along the way. Also, higher rates mean higher future returns for new bond investments, so there is a silver lining to the nasty “bomb cyclone” that hit bonds in 2022.

Looking ahead to 2023 and beyond

Since our updates are titled the “review and outlook,” what about the outlook? The past is the past, and the future is what matters in investing. Although we believe that it is impossible (and foolish) to provide a one-year forecast for stock performance with any sort of accuracy, we can offer what we believe are some of the key factors to watch as the year unfolds.

Stocks – not cheap, but more reasonably priced – Based on current prices and forecasts, the S&P 500 is trading at about 17x the consensus 2023 Earnings Per Share (EPS) forecast. This is about one point higher than its historical average, so, despite the recent plunge, stocks aren’t “cheap.” However, they are no longer “expensive.”

The dividend yield on the S&P 500 is about 1.5%, which is an improvement from the frothy 1.2% at the end of 2021 but still well below the 2.2% yield at the end of 2012. A 5% to 7% dividend growth rate implies a 6.5% to 8% long-term return for the S&P 500. This range is a bit higher than the 5%-7% range we estimated one year ago, but still below the historical 9%-10% annual return range.

This range of returns is for a 10-to-20-year time horizon, however, and 2023 returns will depend on a variety of factors (good or bad), many of which aren’t on anyone’s radar. If the Fed “pivots” sooner than expected, then stocks will probably take off. If the impending recession is very light (or we have the proverbial “soft landing”) then stocks should also react favorably. However, if inflation remains stubborn, or if the economy dips deeper than analysts expect, then stocks may take another leg down. This game of speculation over expectations and “Fed watching” and “whisper numbers” and “what’s priced in” is played every year, and we strongly suggest that you don’t play it, because the range of outcomes is so wide you could drive a truck through it.

Bonds – out of the woods, especially if inflation cools – Unlike stock returns, bond returns are easier to forecast, as your return on an individual bond is literally spelled out for you (assuming the issuer doesn’t default and you hold to maturity). When the yield on the 10-year treasury bond dipped to 0.55% in 2020 as every investor in the world fled to the safest assets they could find, buyers of those bonds shouldn’t have been surprised at the subsequent disappointing returns. (The joke at the time was that bonds provided the buyer with “return-free risk.”) The punchline of the joke hit in 2022 when the yield on a 10-year treasury bond tripled from 2021 and the Fed Funds Rate went from 0.0000% to over 4%.

However, bond investors are now reaping the benefit of rising interest rates, because future returns are now much higher than they have been in years. That’s how the math works. One and two year CDs are yielding over 4%, and investment-grade corporate bonds can be bought at over 5% yield in many cases. That still doesn’t match our long-term estimated return for stocks, but now their role as a portfolio stabilizer has strengthened. The only major downside to bond investors is stubbornly high inflation (which is why, despite our tepid view of future stock returns, most investors still need a healthy allocation to stocks.)

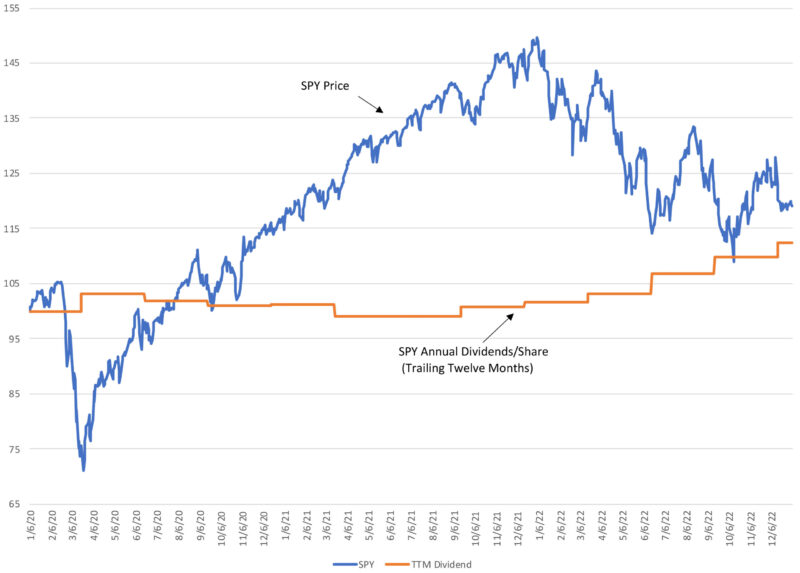

Inflation should continue to moderate, but there is still work to be done – Speaking of inflation, the rate of growth in the Consumer Price Index (CPI) has backed off eyewatering levels (9% in June to 6.5% in December) but is still very high by historical standards. Figure 4 details the most recent report. Energy prices have dropped sharply, and that triggered a negative CPI change for the month of December. The more stable core index is up 5.7% from last December, and up 3.6% annualized in December. Based on the difference in yield between a 10-year treasury bond and an 10-year inflation protected bond (TIPS), the market expects only 2.2% inflation over the next ten years. (The market can also get things wrong, so take this with a grain of salt.)

The Federal Reserve still hiking rates but could slow the pace – The CPI numbers are trending in the right direction, but the Federal Reserve remains committed to absolutely crushing inflation – even if it means pushing the economy into a recession. Right now, there is some uncertainty about when the Fed will be “done” with the rate hikes, because the economic data is very mixed. Looking at the Two-year Treasury Bond yield (which historically has been a rough predictor of the future Fed Funds rate), the market is expecting that they are getting much closer to “done.” Whether “done” happens due to a gentle “soft landing” or a recession is less certain.

Recession almost a certainty – We currently believe that there will most likely be a shallow recession in 2023. It might look like the “tech wreck” of the early 2000s, or maybe something like the early 1990s, when Alan Greenspan torpedoed George H.W. Bush’s re-election chances with a few too many rate hikes. While manufacturing and construction activity is definitely slowing, consumer balance sheets are healthy (thanks to leftover stimulus funds still in savings) and the unemployment rate is an astonishingly low 4%. Thanks to 6%-7% mortgage rates, the housing market is very weak, but banks are much, much healthier than in 2007, when bartenders were given loans to buy $700,000 condos. Shallow recessions turn into deep recessions when excess leverage is involved, and fortunately we don’t think that we are at that point.

Always a few wild cards out there – As we mentioned in our first quarter update, we didn’t have “Russia invades Ukraine” on our 2022 Bingo card. We also didn’t expect Ukraine to fight the much larger Russian army to a standstill. Very few people did. This is why markets are so unpredictable – events that no one expects come out of nowhere. Here are a few “outlier events” that could occur this year, just off the top of our head:

• China invades Taiwan.

• We have a catastrophic solar storm that knocks out communication infrastructure.

• COVID-23.

• A revolution in some minor country sparks a global chain reaction.

• Catastrophic hurricanes flatten Florida (even worse than Ian or Katrina)

• A drought in the Midwest triggers crop failures

That took about two minutes to write, which means the “real” list is much longer. This is scary stuff – who knows what could happen? What we do know is that these types of events happen almost every year, and the economy and the markets adapt and move on. “Bad stuff” happened even during bull markets, when everything looks so rosy in hindsight. Also, there could be “positive” outliers. We sometimes take for granted the medical and technological breakthroughs that occur all the time, but they have been the foundation of human and economic progress.

Knowing all of this, how do we feel about 2023? We feel “ok.” Not great, but far from depressed. Stocks are more reasonably priced (but not cheap) and bond yields have risen dramatically but are still lagging current inflation. The economy is slowing, but we don’t see signs of a deep recession.

We continue to feel “great” about having a solid financial plan coupled with a portfolio of high-quality stocks of well-run companies mixed with investment-grade bonds to suit the needs of the plan. There will always be good years and bad years, but doing the hard work up front and staying out of the daily noise should help you stay on the path to accomplishing your long-term financial goals.

Here’s to health, wealth and happiness in 2023, and please contact us if you have any questions.

Figure 4: Selected Components of the Consumer Price Index (CPI), December 2022