2024 Q1 Review and Outlook – To Cut or Not to Cut

Markets continued rising in the first quarter as stocks (as measured by the S&P 500 SPDR ETF – SPY) gained 10.4%. The U.S. bond market (as measured by the US Aggregate Bond ETF – AGG) declined 0.7%, and a 60% stock/40% bond portfolio recorded a 5.9% total return. Not too shabby considering that the 10% quarterly return for the S&P 500 is a bit higher than the average long-term annual return.

Figure 1: S&P 500 quarterly performance, trailing four quarters.

Still a Two-Tiered Market

The stock market has been defying gravity, which always comes with mixed emotions. While people enjoy opening their brokerage statements, there is always the nagging feeling of “how much higher can it really go?” One popular Wall Street saying is “trees don’t grow to the sky,” which implies an upper limit to how far the market can stretch itself – at least in the short term. (Over a long-term period, the stock market has put even the biggest redwood to shame, turning a $10,000 investment in 1972 to almost $2 million today).

While it is concerning that stocks do feel a bit “stretchy,” the returns of the S&P 500 have been distorted by the huge tech stocks – many of which have been caught up in the A.I. craze. According to research firm Strategas, the valuations of the “Magnificent Seven” stocks (NVIDIA, Microsoft, Apple, Tesla, Meta, Amazon and Google) are elevated relative to the rest of the S&P 500 – a Price/Earnings ratio of about 31 vs. about 21 for the index as a whole. Furthermore, the median S&P 500 stock valuation is about 19, not “cheap” but not even close to “bubble” territory. So, if you widen your net to look at non-mega cap tech stocks, there are still some very good companies selling for reasonable prices.

In any case, valuations have very little predictive power over short-term market returns (i.e. a year or less). However, unusually expensive stocks will be more vulnerable to sharp sell-offs on even moderately bad news (or geopolitical events, such as Iran launching 300 missiles at Israel or Russia invading Ukraine) while unusually cheap stocks tend to rally on the slightest ray of hope. Over a long period of time, the market sorts everything out – usually favoring stocks backed by strong businesses that are bought at reasonable prices and tossing out either the broken businesses (which are often dirt cheap) or the businesses with expensive stocks that can’t meet the high expectations set by the market.

Inflation – Uh Oh.

Speaking of “moderately bad news,” the March inflation report was just released, and the nice, gradual decline in the inflation rate seems to have hit a little snag.

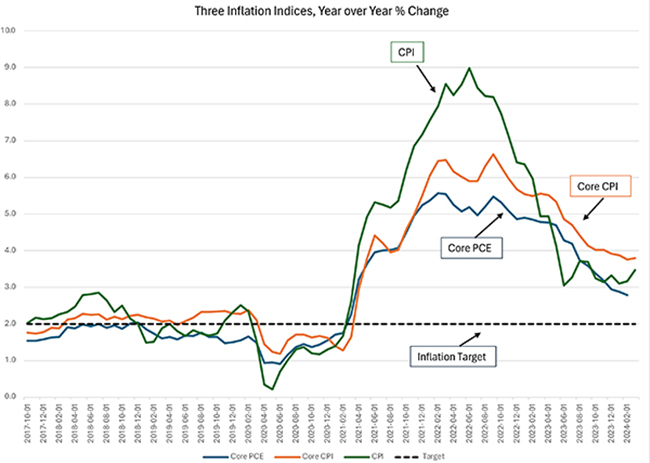

The growth rate of the Consumer Price Index (CPI) increased, to 3.5% from 3.4% in December. The “Core CPI” index (which excludes food and energy and includes 80% of the CPI) managed to seek out a small decrease (3.8% from 3.9% in December), but it was still higher than most economists’ projections and remains much higher than the Federal Reserve’s 2% target. Shelter inflation has been stubborn, and continues to be the largest influence on CPI growth. Energy price growth also made an appearance after 12 months of declines. For those who enjoy silver linings in their clouds, we would note that CPI growth is still far below rates seen one year ago (5.0%/5.6% core) or two years ago (6.5%/5.7% core), and, despite the viral videos of angry grocery shoppers, food price inflation continues to moderate. Figure 2 breaks down the inflation reports since August 2021 by major CPI component.

Figure 2: Contributors to Headline CPI Inflation

Source: Bureau of Labor Statistics

In past reviews, we expected continued improvement in the inflation numbers, owing to a) a tightening Federal Reserve and b) a decline in the money supply, so the latest data gives us some food (and energy and shelter) for thought. On one hand, we have clearly passed the post-COVID stimulus/supply chain collapse heights of 2021 and 2022 where those of us who are old enough had flashbacks to the 1970s – lines for gas, 14% mortgages, polyester suits, and mustard colored shag carpets. Federal Reserve Chairman Jerome Powell – who we suspect is not a fan of polyester suits – had a very clear job to do and he did it, and it all seemed too easy in retrospect, especially after the supply chain restarted. Raise rates, lower inflation. Done and done.

However, as noted above, inflation is still well above the official 2% target. While that was fine as long as the trend kept going in the right direction, the trend is at best “flat,” and nobody thinks that 3.5%-3.8% inflation is an acceptable number.

The Last Bit is the Hardest

Given the current situation, Mr. Powell is in a tough spot. The easy money has been made, so to speak, and the Federal Reserve has done a remarkable job of facilitating what has been a surprisingly “soft landing.” Unemployment is still at 4%, GDP continues to grow at a steady if unspectacular pace, and the stock market has been hitting all-time highs. The problem is that the plane/economy/inflation hasn’t “landed” yet. It is about 200 feet above the runway – at night in the rain with a 30 mph crosswind.

To get an idea of what the Federal Reserve might do to take the last 1%-2% out of the CPI, we must put ourselves in their shoes. What are they seeing? There are conflicting theories and data surrounding the current situation, and the interpretation of these factors will determine how aggressive Mr. Powell and the Fed become.

- It’s an election year. In last quarter’s update, we spent a lot of time discussing the effect of elections on the market (summary: the stock market does equally well no matter which party occupies the White House), and one interesting fact stood out – the stock market almost never declines in an election year where the incumbent is running for re-election. While that may be good news for investors, it is bad news for inflation hawks, because the incumbent party basically bribes the voters to re-elect them. No tax increases, more federal spending, etc. That pumps a lot of money into the economy and fuels the underlying inflationary forces. This implies fewer or zero rate cuts in 2024.

- This may be an inflation “echo.” Many economists we have read or spoken with have anticipated a secondary “echo” of inflation for some time. The reasons are very technical and aren’t entirely understood, but, suffice to say, inflationary forces have lots of undercurrents and “butterfly effects” that only show up later (i.e., now). This complicates the Fed’s decision-making process, because the echo may fade out naturally – or maybe it won’t. This could push the Fed either way, depending on the causes of the “echo.”

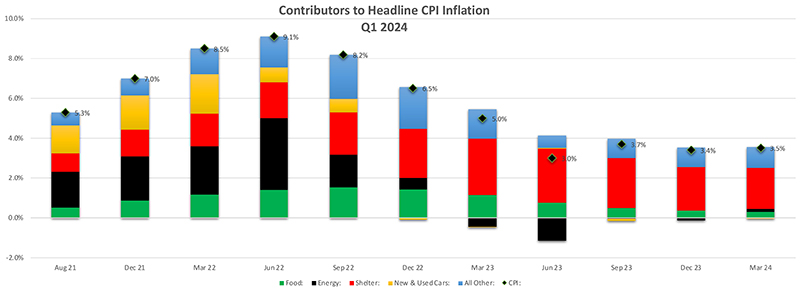

- What is inflation? Depends on how you define it. There are many, many ways to measure inflation. None of them are 100% accurate, and each measure affects people differently. However, we do know that the Fed leans toward one particular measure, which is the Core Personal Consumption Expenditure (Core PCE). The Federal Reserve favors the PCE for several technical reasons, but mainly because it has a more comprehensive measure of services as well as goods prices. CPI is basically a “market basket,” while PCE tries to include more intangible factors. Since the U.S. has become a “service economy” the Fed believes that this measure is more appropriate. As Figure 3 shows, it looks a bit different than the CPI. As of the February report, the Core PCE growth was below 3% and much more benign than the Core or headline CPI (The March will be released in two weeks). A moderate PCE report at the end of the month would favor a looser policy, with some rate cuts.

Figure 3: CPI, Core CPI and Core PCE, October 2017 – March 2024

Source: Federal Reserve Bank, Bureau of Labor Statistics

The Hammer or the Scalpel?

Up until the most recent inflation report, the consensus opinion has been for several rate cuts in 2024 – as early as June – and interest rates drifted lower at the start of the year. However, all that has been thrown into doubt, and the rate cut forecasts were quickly pushed out into the future. A June cut seems almost impossible, even if Mr. Powell’s favorite inflation metric is much more benign than the CPI.

Despite the complexity of the data and the analysis, crushing inflation is fairly straightforward – raise short-term rates to 10% and make huge cuts to government spending. Inflation would disappear – and so would a big chunk of the economy. While small-government and fiscal hawks have banged the drum for balanced budgets for decades, cutting government spending and/or aggressively raising rates at this moment is a political impossibility (see point #1 above – “It’s an election year.”) While we are strongly in favor of responsible spending and lower deficits as a solid long-term strategy, hammering the economy into the ground probably isn’t a feasible (or desirable) strategy at this time.

The Federal Reserve Board of Governors understands this and knows that it has a limited set of tools to do the job – more like a set of scalpels. Higher interest rates can help reduce spending on big ticket items such as cars and houses (car prices have come down, houses…not so much) and also pull money away from business expansions, as high returns on cash raise the hurdle for new capital investments. But the effects have what are known as “long and variable lags.” The drag on the economy slowly builds up over time rather than all at once. They also understand that short-term rates are still much higher than even the most pessimistic inflation measure, so they are already somewhat restrictive (despite the packed airports and restaurants).

This dynamic highlights Mr. Powell’s dilemma – inflation is higher than his target, but short-term interest rates are higher than inflation. If he keeps rates too high for too long, then the risk of breaking the economy increases. However, cutting rates too soon could pour gasoline on the fire, triggering the dreaded “wage price spiral” where sustained high inflation causes workers to demand higher raises, which causes companies to raise prices even more, which triggers more demands for raises, and so on. After that, the house-flippers on HGTV will be replacing the shiplap with wood paneling and rolling shag carpet over the hardwood floors because we will be back in the 1970s again.

We believe that the Federal Reserve will continue to prioritize inflation control vs. economic stimulus. Despite what the amateur economists on Tik-Tok and Twitter/X say, the U.S. economy is doing fairly well, especially compared with Europe or China. This strength provides the Federal Reserve with more room to keep rates in restrictive territory for longer than originally expected, which means more expensive mortgages and car loans for a while and muted economic growth.

This may put pressure on the more expensive parts of the stock market in the short term, as those companies have to jump over high growth hurdles in a slowing economy. However, diversified portfolios of stocks from a variety of sectors coupled with lower-risk bond allocations should continue to (literally) pay dividends for long-term investors – especially investors who match their portfolios to their overall financial plans.

We hope everyone enjoys the warmer temperatures and blooming flowers, and we will be back with another update in July. Please contact us if you have any questions.